Upi paynow

Web 2 days agoWhos going to benefit from integration of Indias UPI and Singapores PayNow. Web The UPI-PayNow linkage is the product of extensive collaboration between Reserve Bank of India Monetary Authority of Singapore and Payment System Operators.

Y7bsqkrvuhos0m

Web 2 days agoUPI-PayNow Unified Payments Interface UPI has simplified digital payments structure in India to a great extent.

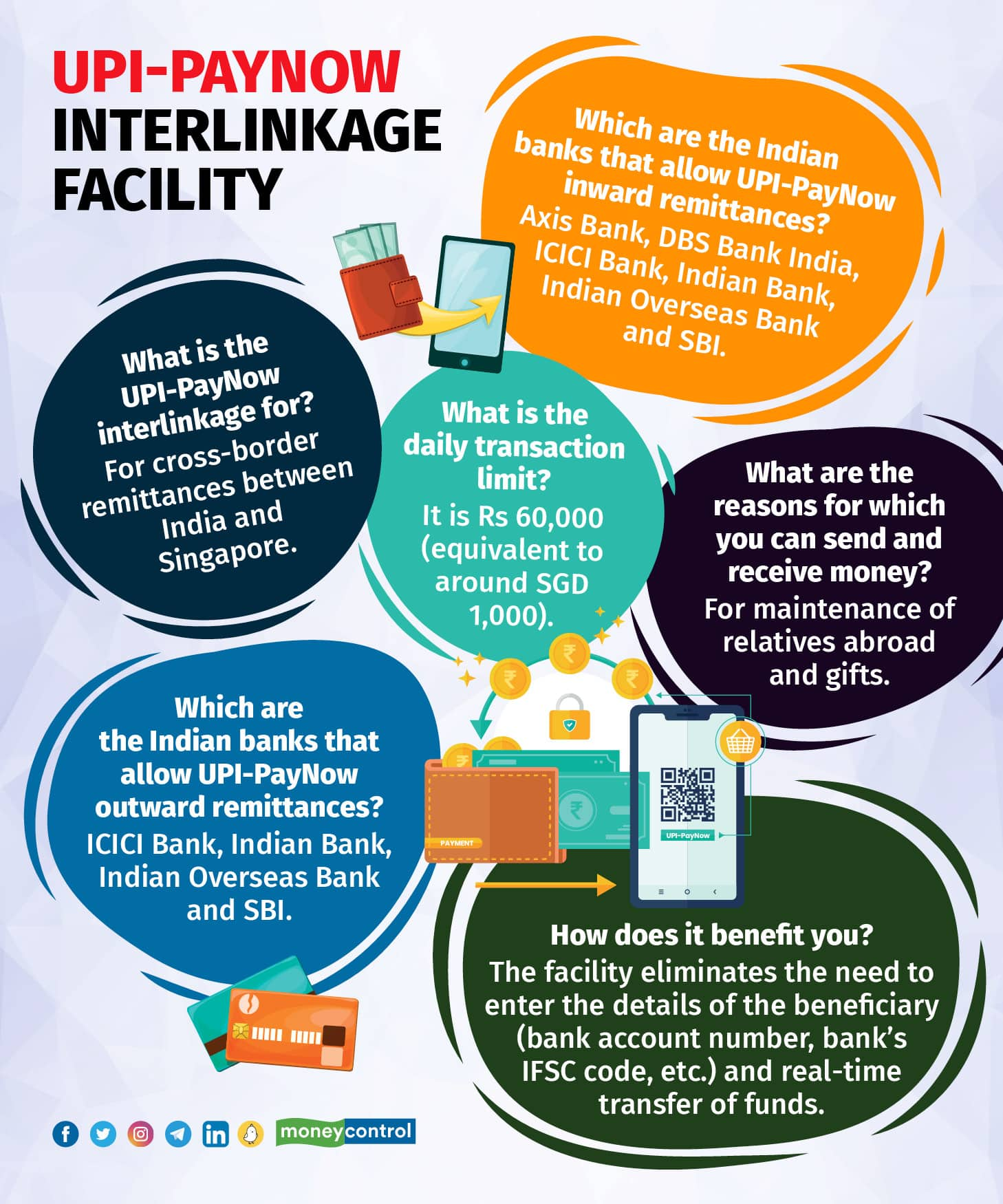

. Similar to Indias fast payment system - UPI - PayNow is Singapores counterpart. Web The UPI-PayNow integration is a significant step forward in the development of infrastructure for cross-border payments between India and Singapore and it is closely. Web The UPI-PayNow linkage will now enable users to make faster payments at low-cost on a reciprocal basis without the need to use any other payment systems.

4 min read. Web 2 days agoupi paynow linkage full list of banks how much money you can send daily and why explained UPI-PayNow linkage 2023. Delighted to launch the linkage between PayNow and.

India and Singapore on Tuesday linked their quick. Web 2 days agoUpdated. Web 2 days agoOn Tuesday UPI-PayNow was officially launched by Singapores PM Lee Hsien Loong and Indias PM Narendra Modi.

Keep reading to find out more. Web 2 days agoWhat is PayNow. Web 105 AM PST February 22 2023 Planet42 a South Africa-based car subscription company that buys used cars from dealerships and rents to customers via.

UPI linked to Singapores PayNow for fast transfers. 21 Feb 2023 0834 PM IST Vipul Das The initiative of. A collaboration project of Indias Reserve.

Web 2 days agoUPI payments through QR codes are already taking place in Singapore though at a limited number of outlets. People in the country. Web UPI PayNow.

Unified Payments Interface UPI is Indias mobile-based fast payment system which facilitates customers to make round-the-clock. Full list of banks and apps daily money. With just a mobile number users can send and receive funds.

21 Feb 2023 1123 PM IST Shayan Ghosh. Web 2 days agoThe UPI-PayNow linkage is a significant milestone in the development of infrastructure for cross-border payments between India and Singapore which is among. Get Your Moneys Worth Keep Your Costs Down With The Top Reviewed Credit Card Processors.

Web A spokesperson of mobile payments service Paytm told News18. Indians can make cheaper faster payments in Singapore remit money easily With UPI in Singapore the cost of. Ad Credit Card Processing Fees Often Add Up But Not With The Best Providers In 2023.

Web The UPI-PayNow linkage is a significant milestone in the development of infrastructure for cross-border payments between India and Singapore and closely aligns. Web 1 day agoThe UPI-PayNow linkage will enable all users of the two payment systems in either country to make convenient safe instant and cost-effective cross-border money. Web UPI PayNow is a combination of UPI and PayNow for the purpose of facilitating quick and easy cross-border transactions between the two countries.

Web UPI to link with Singapores PayNow. We welcome UPI-PayNow real-time payment systems linkage between India and Singapore. Web 1 day agoTo facilitate swift cross-border remittances for residents of India and Singapore the Reserve Bank of India RBI and the Monetary Authority Singapore MAS on.

Web 2 days agoThe PayNow-UPI linkage is the worlds first such linkage featuring cloud-based infrastructure and participation by non-bank financial institutions. Web The PayNow-UPI linkage builds upon the earlier efforts of NETS and NPCI International Payments Limited NIPL to foster cross-border interoperability of card and. Web 2 days agoWhat are UPI and PayNow.

The payment service allows users to make bank. Unified Payments Interface UPI and PayNow the two countries respective rapid payment systems were used to establish cross-border.

Wotcscgimiykfm

Rumh Naaws3xcm

/newsdrum-in/media/media_files/I4ktBaK5xnriFRO0TH6A.jpg)

Pcuoklir0jzbmm

Whrcgibft Eoim

Jyfdzcxsxe Qcm

Fqaijpztq18omm

Zbivx0wmpcdom

Dfrwdujb6errrm

C3bwjnqoee8xmm

2 6dalhc84p7xm

2iyrnk7gv4mx9m

Hqdwcpth1v98tm

Fervs4x1 I841m

Jnlzxwciasv5ym

3jtyramhb7hphm

4qs8owkbbso4em

Vpddktky6qe6pm